How To Calculate Earnings Per Share From Balance Sheet

PE Stock Price Per Share Earnings Per Share. Next divide the earnings total you just calculated by the number of outstanding shares listed on the balance sheet.

Earnings Per Share And Other Indicators Principlesofaccounting Com

This will give you the EPS.

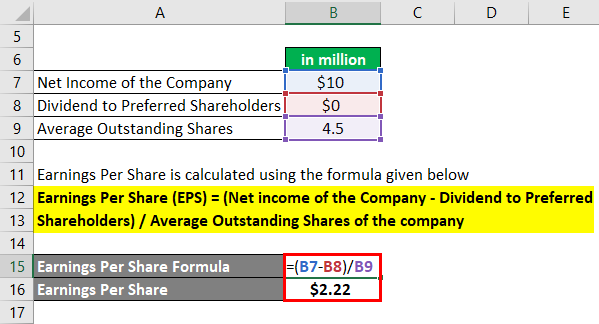

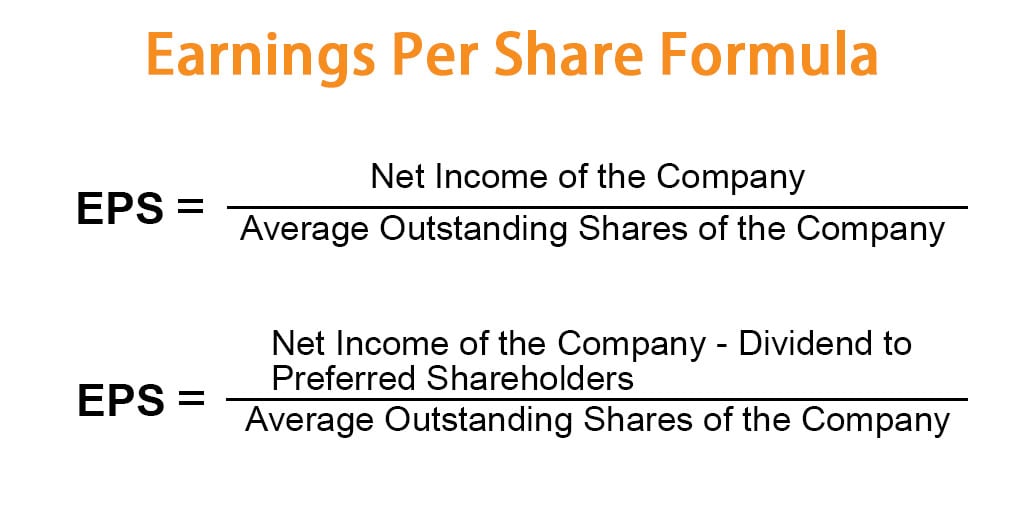

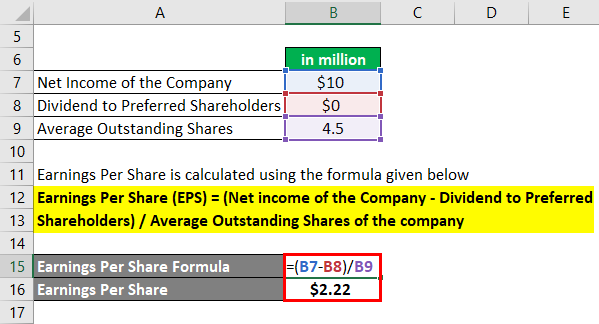

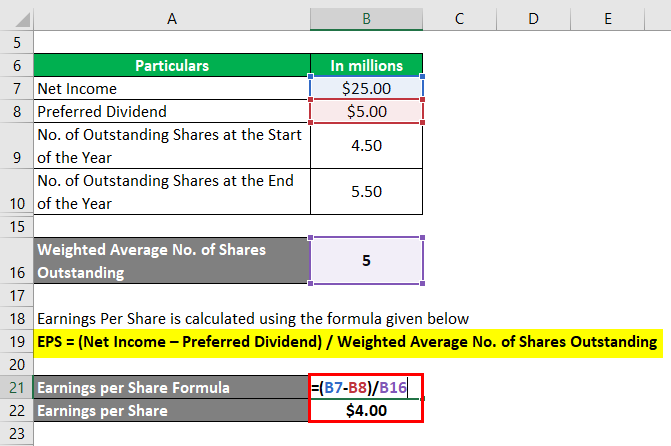

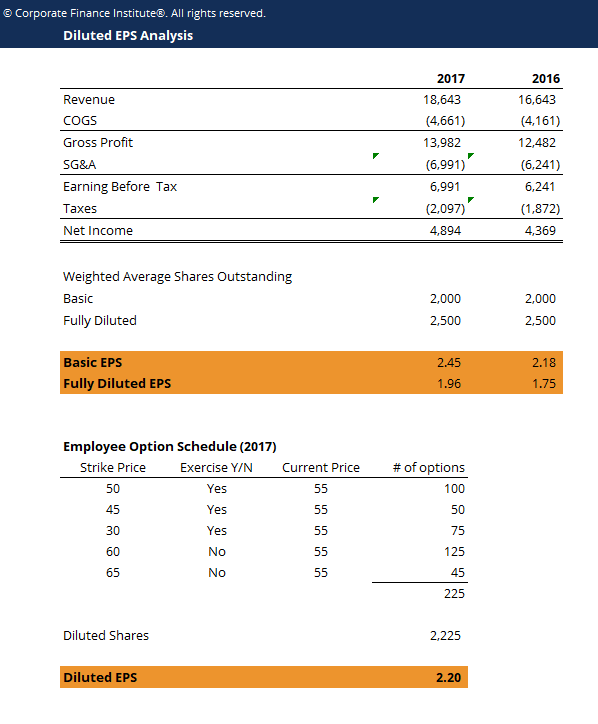

How to calculate earnings per share from balance sheet. Valuation models use fully diluted EPS because it. Earnings per Share Formula. This will give you the EPS.

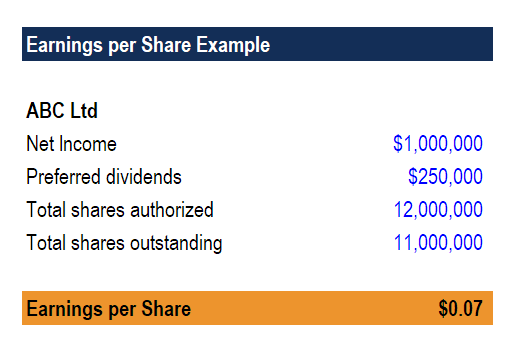

Step 1. The net income or loss is added to the retained earnings number on the balance sheet. First subtract the preferred dividends paid from the net income.

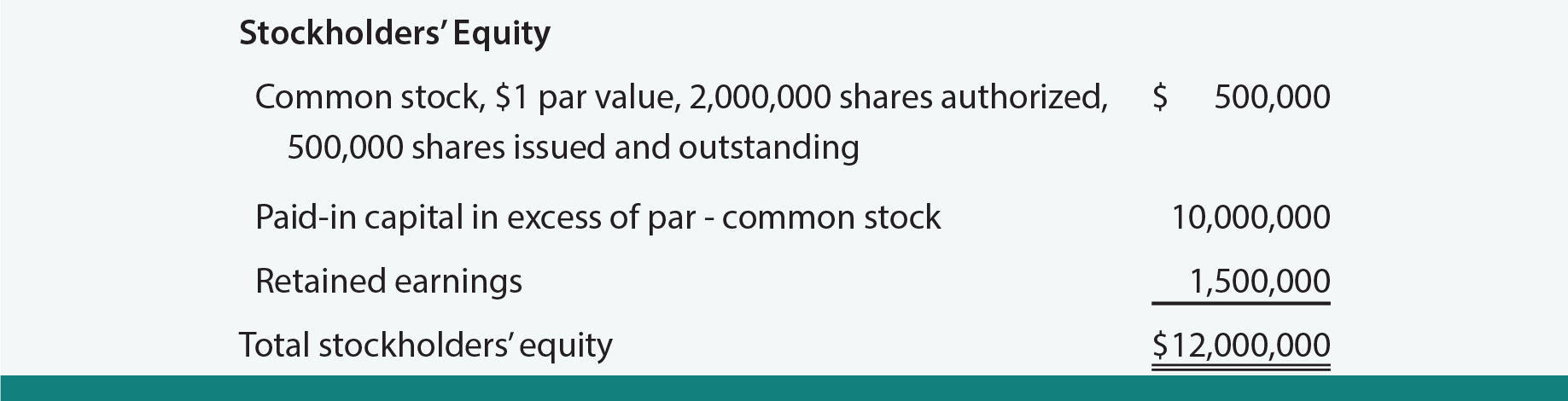

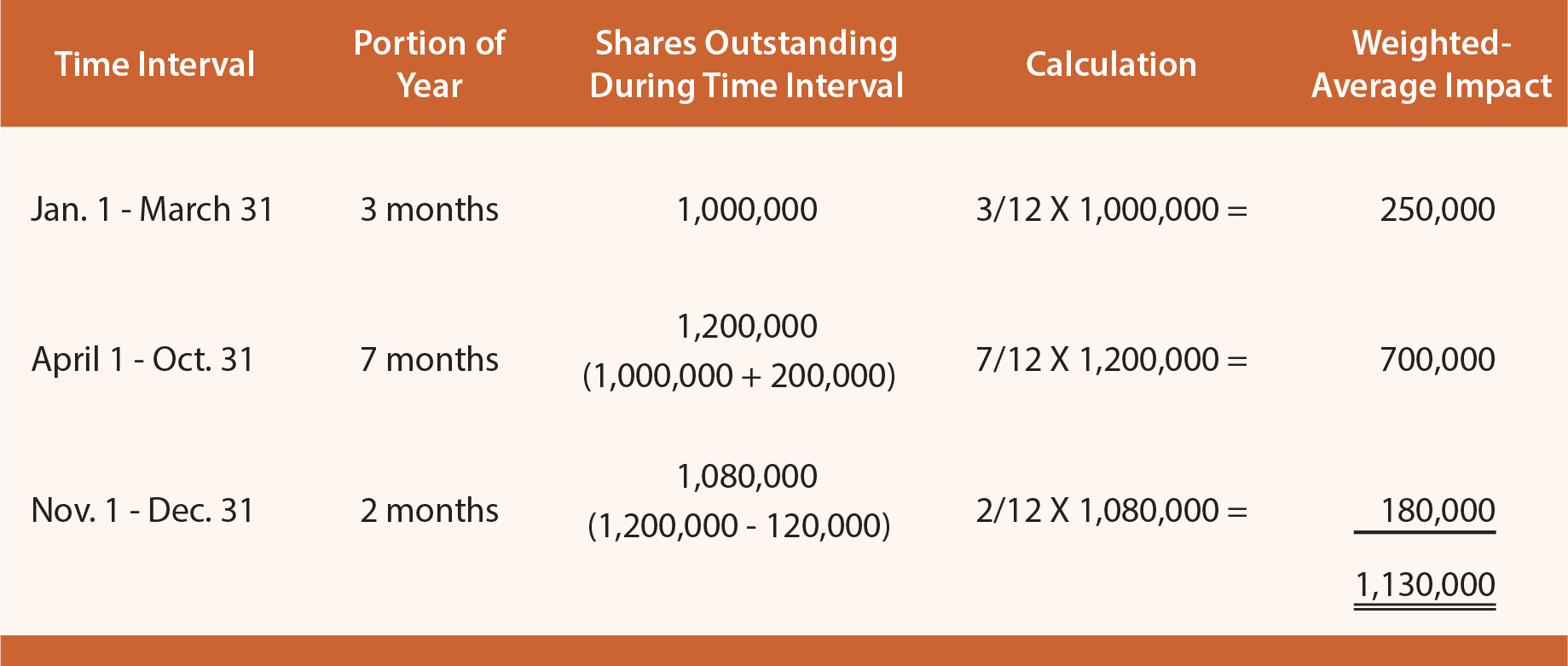

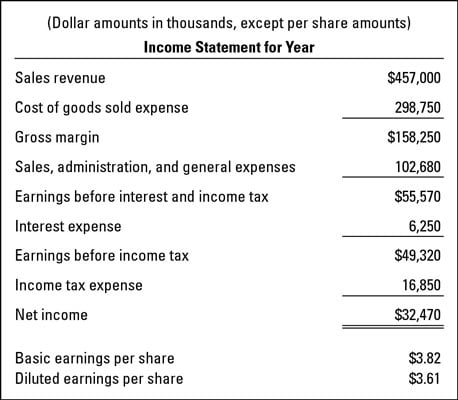

The earnings per share calculation for the year would then be calculated as earnings divided by the weighted average number of shares 200000150000 which is equal to 133 per share. Earnings per Share Net Income - Preferred Dividends Number of Common Shares Outstanding. Per share from the.

Find your net worth on the balance sheet. Current retained earnings Net income - of shares x FMV of each share Retained earnings 9000 10000 - 500 x 10 14000 This means that on April 1 retained earnings for the business would be 14000. Price Earnings Ratio Formula.

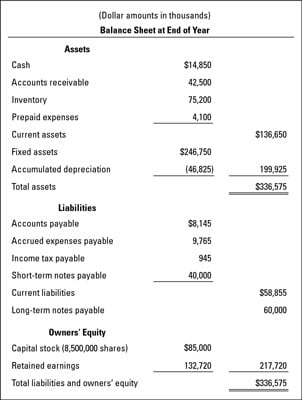

So now we can see that the balance sheet equation says which is Total assets Total Liabilities Total equitys shareholders and in this case it is 183500. How do you calculate earnings per share on a balance sheet. Total Assets 25000 25000 83500 30000 20000.

How do you calculate retained earnings on a balance sheet. This will tell you the total earnings available to common shareholders. PE Ratio Formula Explanation.

Any dividends declared per share appear on the income statement under the earnings per share information. You find the amount of dividends paid on the statement of cash flows. There are several ways to calculate earnings per share.

And since dividends are subtracted from net income to calculate retained earnings they are also listed in the stockholders equity section of the balance sheet. EPS Net Income. Total Assets 183500.

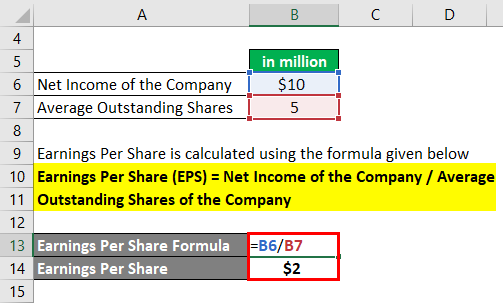

EPS net incomenumber of shares 90 million35 million 257. Revenue is the income earned from. Think of the difference between the book value of a stock and the market price per share.

PE Market Capitalization Total Net Earnings. Below are two versions of the earnings per share formula. EPS Net incomenumber of shares outstanding Example.

Next divide the earnings total you just calculated by the number of outstanding shares listed on the balance sheet. Earnings per share is a profitability ratio that determines the net income earnings per each share of stock in a company outstanding at the end of a given year. The ratio is calculated by subtracting a companys preferred dividend from its Net income dividing the answer by.

G Sustainable Growth Rate. The formula for calculating earnings per share is. EPS Net Income Preferred Dividends End of period Shares Outstanding.

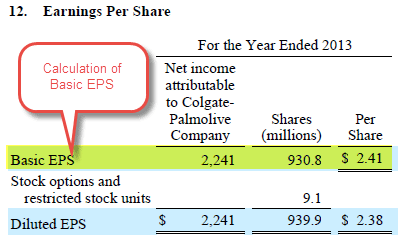

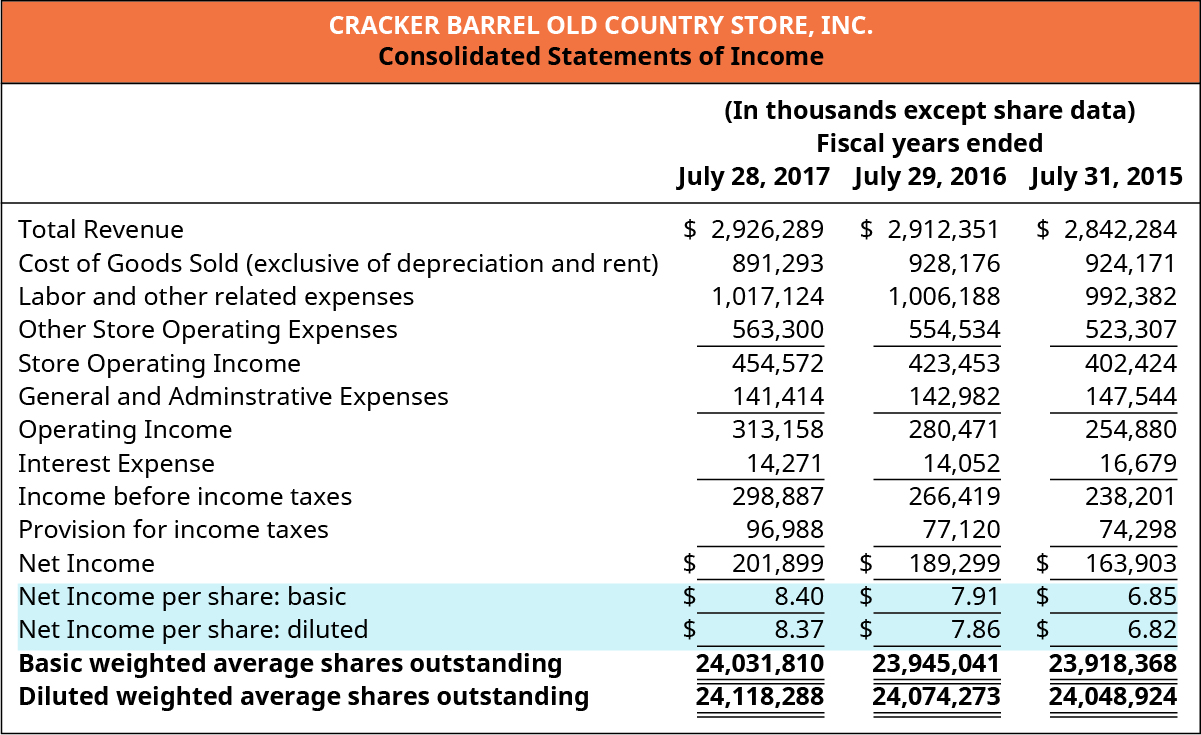

This video explains how to calculate Earnings Per Share EPS and uses the formula to solve an example problem Edspira is the creation of Michael McLaughli. Divide the earnings available to common shareholders by the number of shares outstanding to find the EPS. Dividing the same 2761395000 of net income into 454208000 equals an EPS value of 608.

R Required Rate of Return. Retained earnings are calculated by adding the current years net profit if its a net loss then subtracting the current period net loss to or from the previous years retained earnings which is the current years retained earnings at the beginning and then subtracting dividends paid in the current year from the same. In this example if the company has 400000 common shares outstanding divide 117 million by 400000 to find the company has 2925 in EPS.

We can use the income statement to determine the earnings per share EPS and dividends. Try any of our Foolish newsletter services free for 30 days. A firm reports a net income 90 million and has 35 million shares outstanding what will be the earnings per share EPS.

Justified PE Dividend Payout Ratio R G. Retained earnings are an accumulation of a companys net income and net losses over all the years the business has been in operationRetained earnings make up part of the stockholders equity on the balance sheet.

Earnings Per Share Formula Eps Calculator With Examples

/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-01-7cc050483472487f95e4bbe119e8d554.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

Earnings Per Share Eps Desjardins Online Brokerage

Earnings Per Share Formula Eps Calculator With Examples

Calculating The Earnings Per Share Eps Ratio Dummies

Earnings Per Share And Other Indicators Principlesofaccounting Com

Earnings Per Share Eps Meaning Formula Calculations

Price To Earnings P E Ratio And Earnings Per Share Eps Explained Youtube

Earnings Per Share Advantages And Limitations Of Earnings Per Share

How Do Earnings And Revenue Differ

Statement Of Stockholders Equity Earnings Per Share Accountingcoach

Diluted Eps Formula Example Calculate Diluted Earnings Per Share

Earnings Per Share Eps Meaning Formula Calculations

Earnings Per Share Advantages And Limitations Of Earnings Per Share

How To Calculate Eps Earnings Per Share Youtube

Discuss The Applicability Of Earnings Per Share As A Method To Measure Performance Principles Of Accounting Volume 1 Financial Accounting

Earnings Per Share Learn How To Calculate Basic And Diluted Eps

Calculating The Earnings Per Share Eps Ratio Dummies

Earnings Per Share Formula Eps Calculator With Examples

Komentar

Posting Komentar