How To Calculate Earnings Per Share Continuing Operations

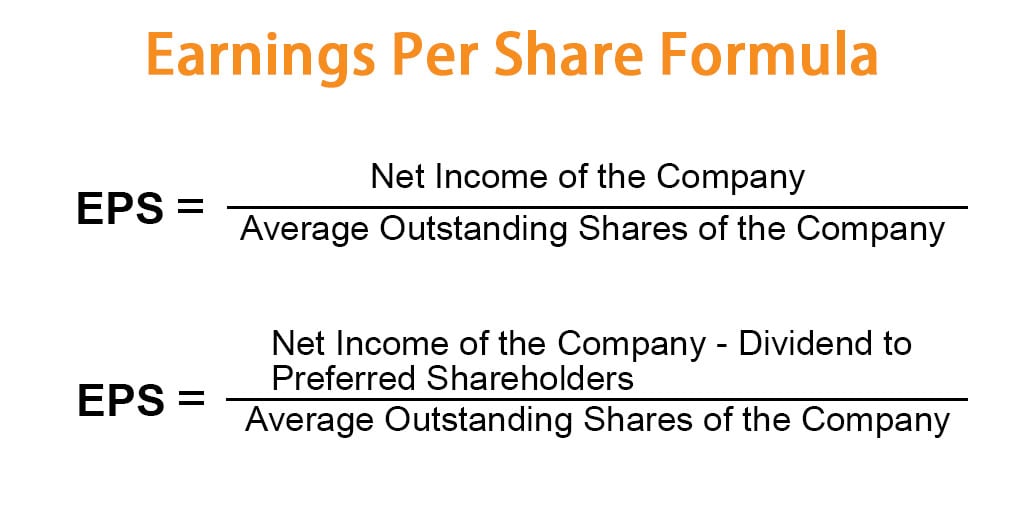

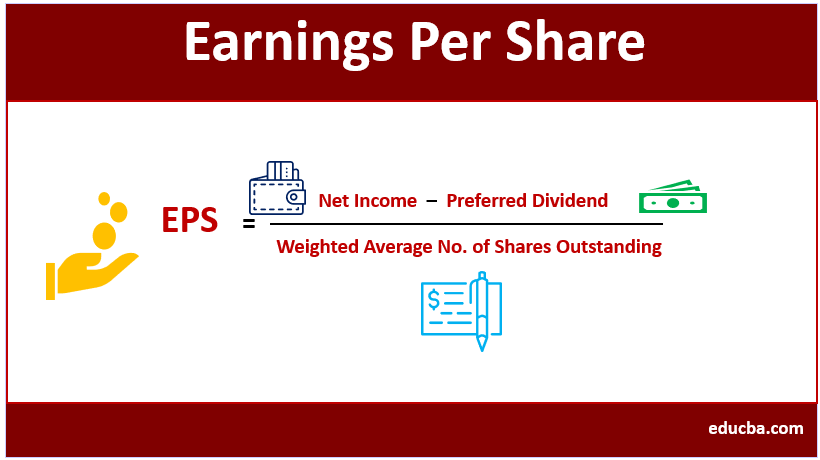

Below are two versions of the earnings per share formula. Diluted Earnings Per Share diluted EPS is a companys earnings per share EPS calculated using fully diluted shares outstanding ie.

Earnings Per Share Dividends Formulas Examples Ratios

Continuing operations discontinued operations extraordinary items and net income.

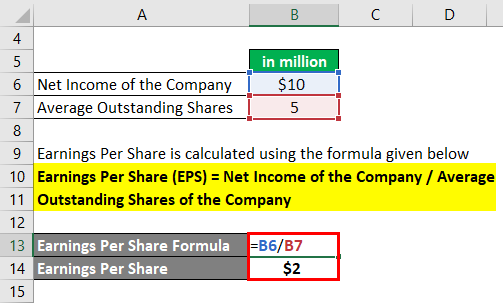

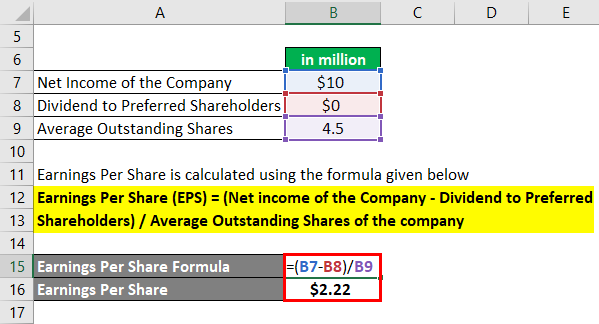

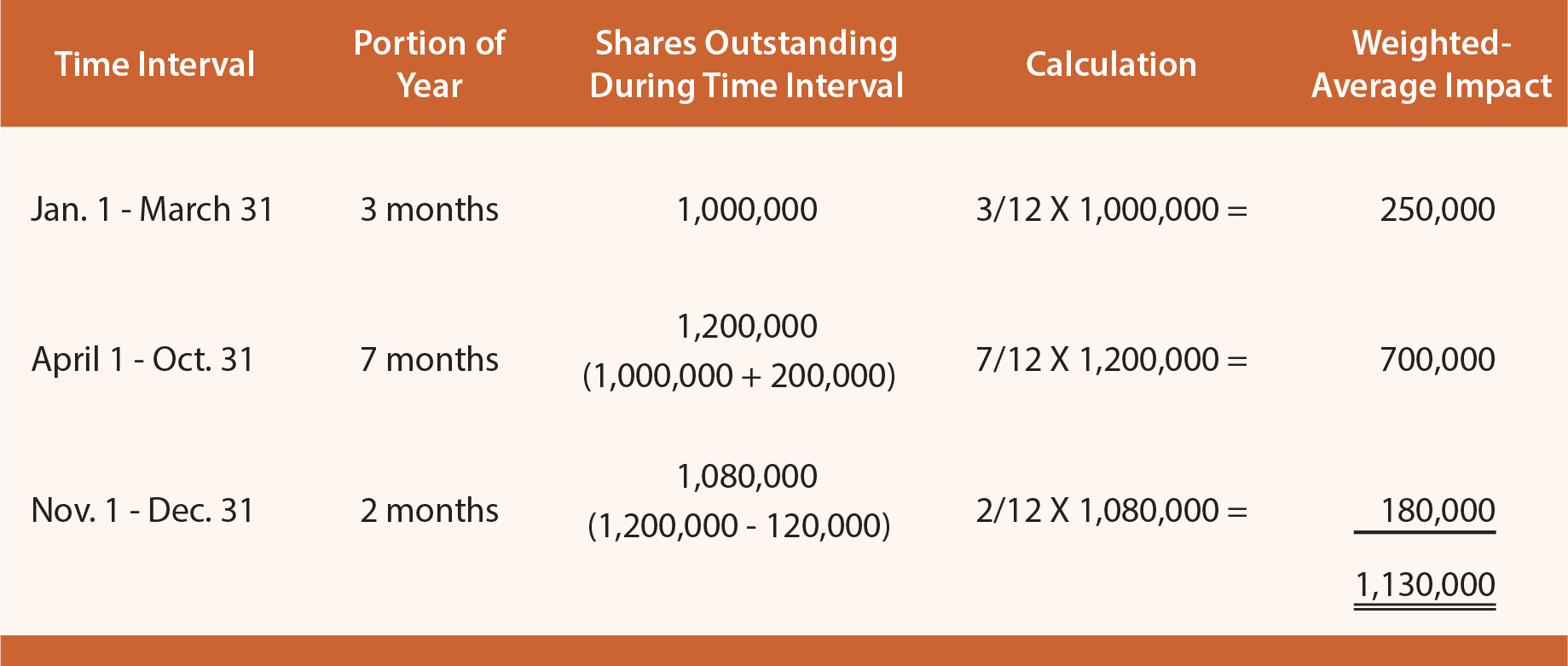

How to calculate earnings per share continuing operations. The calculation of Basic EPS is based on the weighted average number of ordinary shares outstanding during the period whereas diluted EPS also includes dilutive potential ordinary shares such as options and convertible instruments if they meet certain criteria. EPS Total Earnings Outstanding Shares. Price Earnings Ratio Market Price Per Share Earnings Per Share.

Add together the income from discontinued operations net of taxes and the gain on sale net of taxes to calculate the total income from discontinued operations net of taxes. The formula for basic earnings per share is. Steps to calculate basic earnings per share 1.

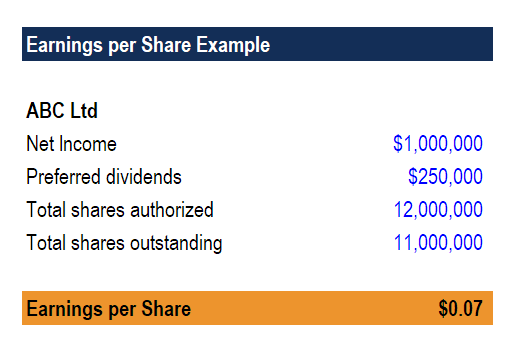

Earnings per share or EPS measures the performance of a publicly listed company. Earnings are synonymous with profit and net income. We will also distinguish income from continuing operations vs discontinued operations.

IAS 33 sets out how to calculate both basic earnings per share EPS and diluted EPS. The profit or loss from continuing operations attributable to the parent company. EPS Net Income.

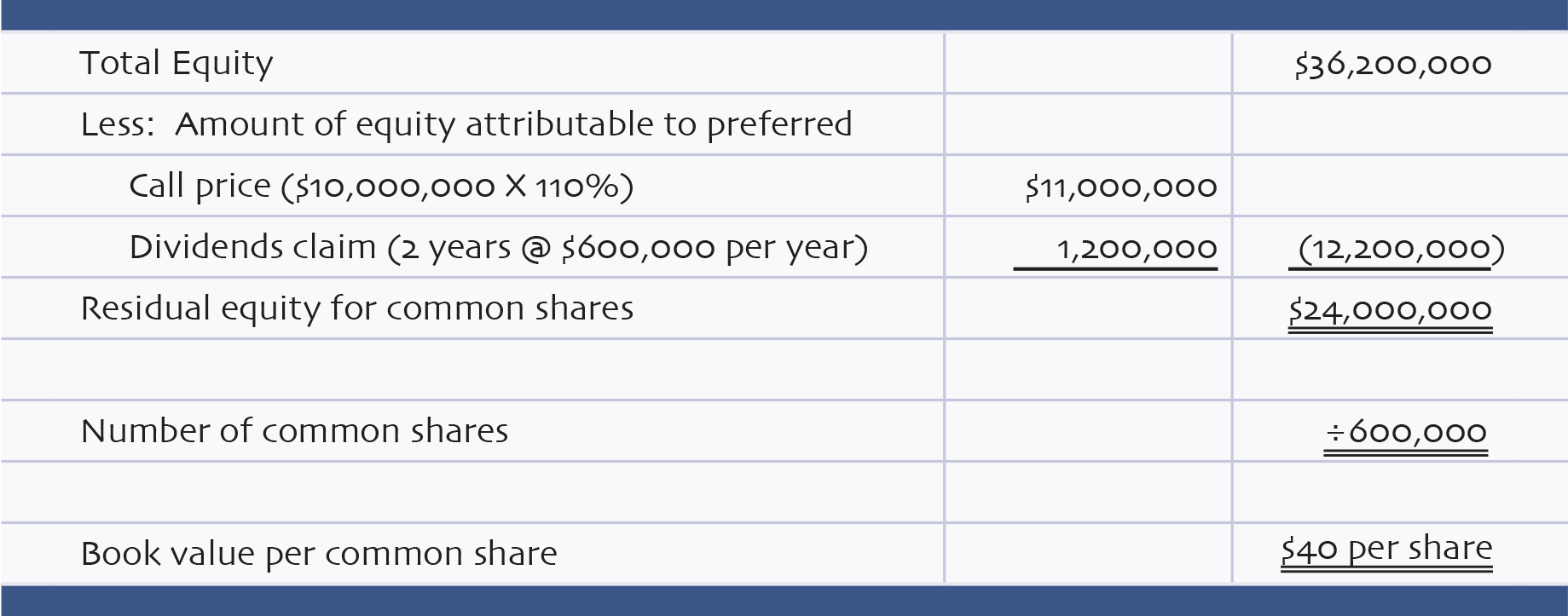

EPS Net Income Preferred Dividends End of period Shares Outstanding. This is simply the stock price per share divided by the annual EPS. The total profit or loss attributable to the parent company.

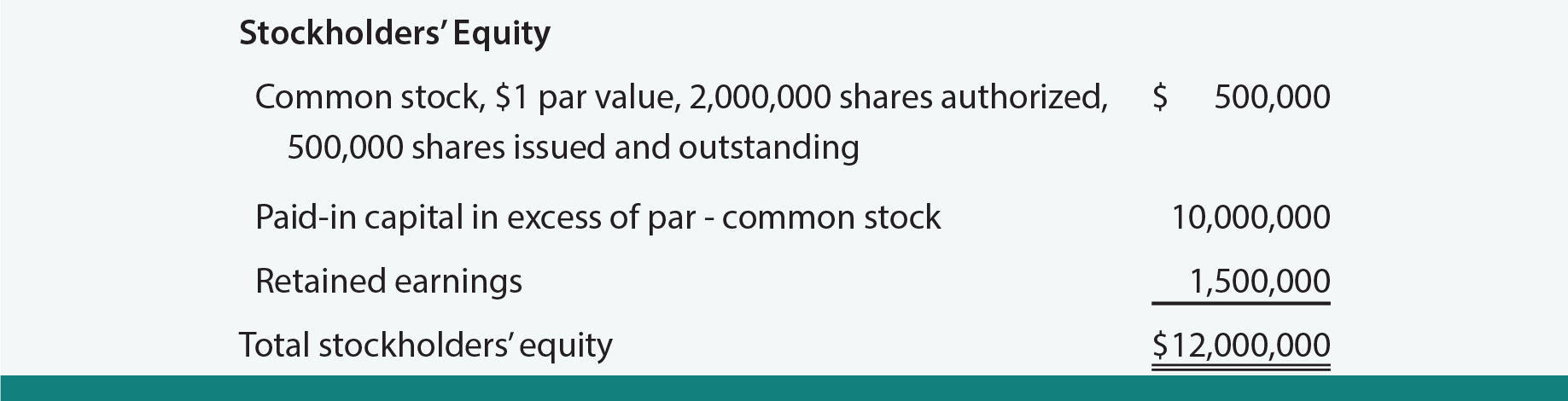

EPS is simply the companys total dollar earnings for a given period divided by the number of shares outstanding. Profit or loss attributable to common equity holders of the parent business Weighted average number of common shares outstanding during the period. For example a stock selling at 15 per share with 1 of EPS would have a PE of 15.

Flexible Online Learning at Your Own Pace. It is calculated by dividing the companys net income with its total number of outstanding shares. In addition this calculation should be subdivided into.

This ratio is therefore an indicator of how many times years the earnings would have to be repeated to be equal to the share price of the entity. In this example add 40000 and 35000 to get 75000 in total income from discontinued operations net of taxes. Determine the number of shares outstanding Shares outstanding is the number of shares.

EPS continuing operations formula Income from continuing operations Weighted Average Common shares. Invest 2-3 Hours A Week Advance Your Career. Lastly we will better understand the impact of various accounting changes.

There are several ways to calculate earnings per share. Determine the companys net income from the previous year Using a companys net income or earnings for the primary. The price-earnings ratio which is calculated by dividing the price of an ordinary.

Earnings per Share Formula. So its like if you have earnings for a company they divide it by number of shares available in that comnpany to find out how much its earned per share. After-tax interest on convertible debt Convertible preferred dividends.

Since EPS from Continuing Operations is not a standard line item and companies vary in what they report on their income statements we calculate this number on a case-by-case basis. Earnings per share is calculated by dividing the companys total earnings by the total number of shares outstanding. This is one of the most popular indicators in the fundamental analysis which is calculated by dividing the net profit of a given period by the number of issued common stocks.

Profit or loss attributable to common equity holders of parent company. Davis CPA CMA CFM CCM. Other companies may have a PE of 5 or 25.

Basic earnings per share. The formula is simple. An entity shall calculate basic earnings per share amounts for profit or loss attributable to ordinary equity holders of the parent entity and if presented profit or loss from continuing operations attributable to those equity holders.

Ad Build your Career in Data Science Web Development Marketing More. Discontinued Operations and Earnings Per Share 440. This dilution may affect the profit or loss in the numerator of the dilutive earnings per share calculation.

Basic earnings per share. Users of financial statements also. EPS is a financial indicator that shows how much profit a company has generated per one common stock.

Including the impact of stock option grants and convertible bonds. Share by its EPS amount. The Financial Accounting Standards Board requires companies income statements to report EPS for each of the major categories of the income statement.

Earnings Per Share Formula Eps Calculator With Examples

Earnings Per Share Advantages And Limitations Of Earnings Per Share

Earnings Per Share Formula Eps Calculator With Examples

Earnings Per Share Ratio Eps Ratio Formula Example Importance

Earnings Per Share Formula Eps Calculator With Examples

Earnings Per Share And Other Indicators Principlesofaccounting Com

Earnings Per Share And Other Indicators Principlesofaccounting Com

Earnings Per Share Flashcards Quizlet

Reporting And Analyzing Equity Boundless Accounting

Earnings Per Share Flashcards Quizlet

Earnings Per Share And Other Indicators Principlesofaccounting Com

Earnings Per Share Learn How To Calculate Basic And Diluted Eps

Solved Exercise 4 8 Presented Below Are Selected Ledger Chegg Com

Earnings Per Share Eps Ppt Download

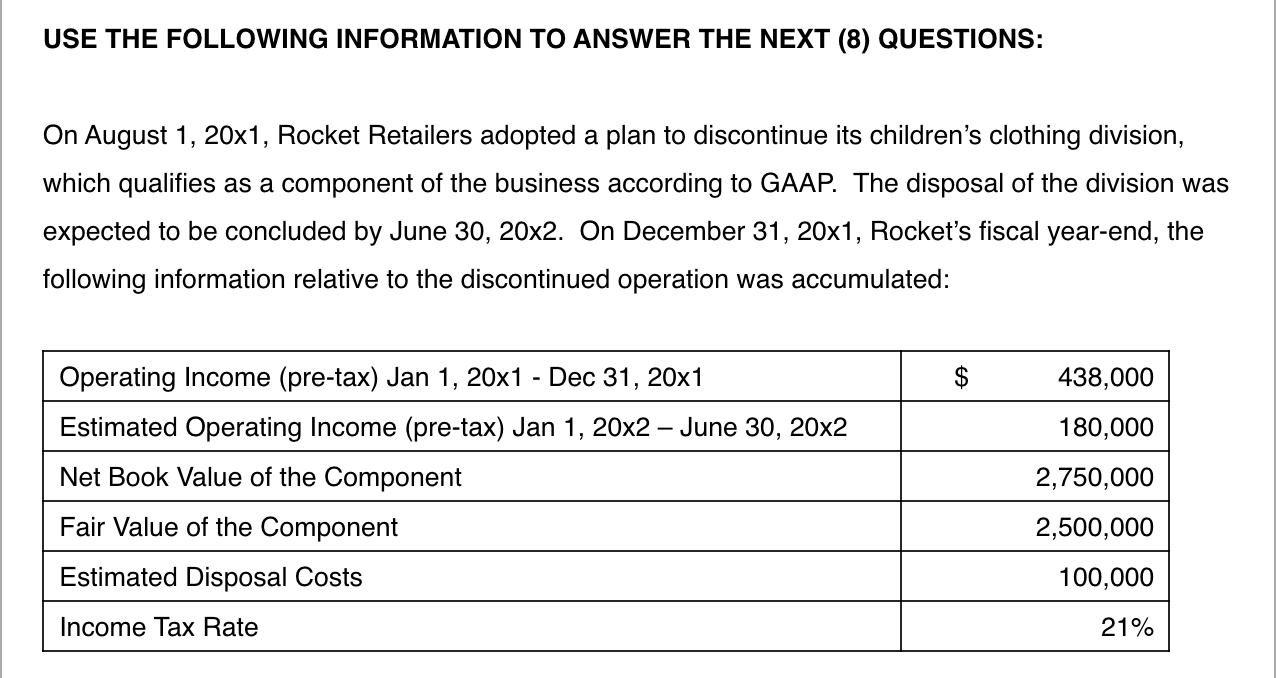

Solved Use The Following Information To Answer The Next 8 Chegg Com

Intermediate Accounting October 12th Ppt Video Online Download

Solved Brief Exercise 4 5 Income From Continuing Operations Chegg Com

Earnings Per Share Dividends Formulas Examples Ratios

Komentar

Posting Komentar